We Navigate,

You Succeed.

Our Strategies

Our multi-strategy alternative asset platform was designed to provide different types of investors with varying ways to execute their investment objectives within private markets. Beyond achieving specific investment goals, our platform was also created to be solutions-oriented and to remove operational pain points that are more common with private market investments. Many of our investment offerings have been structured and tailored to meet specific mandates for our investor base.

How We Invest

As a multi-strategy platform, we offer a diverse set of curated alternative investment strategies. Our platform provides access to independently vetted allocations across direct investments, single-asset managers, and diversified multi-manager portfolios—all of which can be tailored to meet the specific needs of our investors. Our funds and strategies are typically structured through the following bespoke vehicles:

Direct Investments

Access Funds

Fund Solutions

Our Process

Our approach is rooted in empowering investors to identify and capitalize on high-quality opportunities within global financial and equity markets. What distinguishes us is our capacity to deliver fully customized learning programs, enabling investors to deeply understand and master specialized alternative asset strategies in alignment with their personal development goals. We uphold the highest standards in education and research, ensuring that each investment opportunity undergoes rigorous evaluation. At the same time, we leverage cutting-edge technology to deliver a seamless and intuitive experience for every investor.

Tailored Solutions

Since our inception, we have specialized in constructing tailored investment solutions that provide access to alternative asset classes. Many private wealth advisors, family offices, and institutions have adopted our model seeking deeper involvement in their alternative investments—such as defining specific objectives, enhancing transparency, and refining asset allocation—without committing additional internal resources. These clients seek the benefits of direct alternative investment without the burden of expanding teams or investing in specialized infrastructure. With our solution-driven partnership, WealthTech acts as an extension of their team, delivering performance comparable to internally managed funds while eliminating the need for large investments in personnel, due diligence, operations, and administrative overhead.

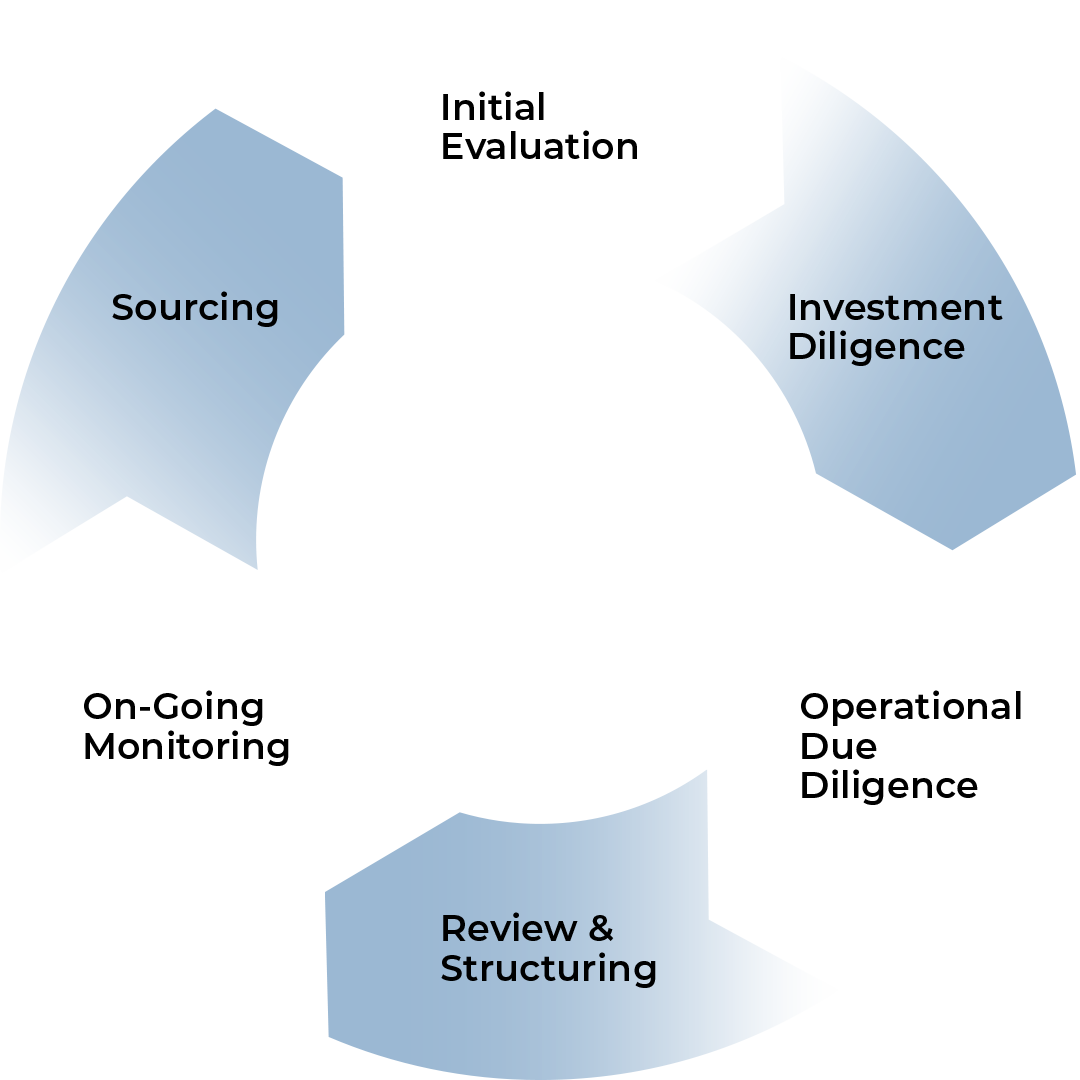

Comprehensive Diligence

The foundation of our alternative investment platform is rigorous due diligence. We are not a fintech marketplace for alternative investments; rather, each fund and strategy available on our platform has been carefully curated, underwritten, and selected specifically for our investor base. For every investment offering, we develop a clear and well-supported thesis, and we actively monitor each position through its entire lifecycle. Our diligence framework has been applied across hundreds of investments, ensuring disciplined and informed capital allocation.

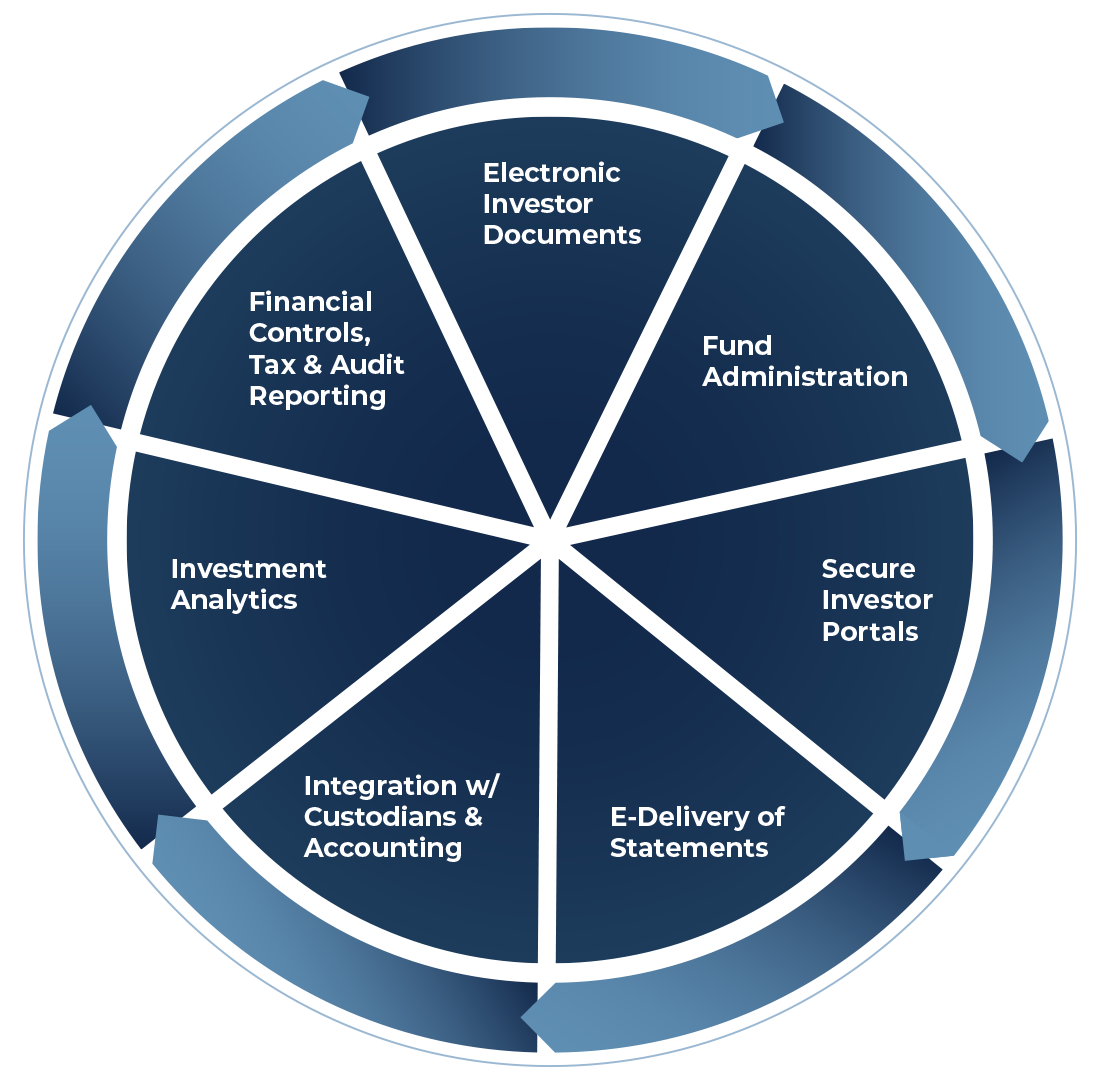

Technology & Client Service

A smooth investor experience is fundamental to our firm and our clients. To deliver exceptional service, our platform employs integrated technology designed to streamline the operational complexities of alternative investing.